1 Any person dissatisfied with any order passed by a Commissioner or a taxation officer under section 121 122 143 144 162 170 182 183 184 185 186 187 188 or 189 or an order under sub-section 1 of section 161 holding a person to be personally liable to pay an amount of tax or an order under clause f of sub. 1271 For the purposes of sub-section 1 of section 282 the addresses including the address for electronic mail or electronic mail message to which a notice or summons or requisition or order or any other communication under the Act hereafter in this rule referred to as communication may be delivered or transmitted shall be as per sub.

To be considered qualified payments must be made in accordance with an employers written educational assistance plan.

. 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after recording his reasons for doing so transfer. Basis period to which gross income from a business is related. Allahabad HC lays down Conditions for Transferring a Case us 127 April 26 2017.

47 of 1967. B 6 23 of the taxpayers income for the year from logging. 127 a 1 In General.

Section 127 of the Income Tax Act 1961 Act for short deals with the power of competent officers to transfer cases. If you are not entitled to such exemptions choose NOT RELEVANT. -- Commissioners Appeals Appellate Assistant Commissioners Inspecting Assistant Commissioners and Income- tax Officers to perform such functions in respect of such area or of such classes of persons or of such classes of income as may be specified in the notification.

A 23 of any logging tax paid by the taxpayer to the government of a province in respect of income for the year from logging operations in the province and. The annual amount of assistance 5250 which has not changed. The key provision of Section 127 allows employers to provide tax-free reimbursement up to 5250 for higher educational courses at.

Residential premises and premises where owing to circumstances owner is compelled to vacate. INCOME TAX EXEMPTION A. Section 127 in The Income- Tax Act 1995.

2 5250 maximum exclusion. Cessation of exemption 128. Under Section 127 of the Internal Revenue Code IRC employers are allowed to provide tax-free payments of up to 5250 per year to eligible employees for qualified educational expenses.

Transfer Order passed under Section 127 of the Income Tax Act 1961 is more in the nature of an administrative order rather than quasi-judicial order and the Assessee cannot have any right to choose his Assessing Authority as no prejudice can be said to have been caused to the Assessee depending upon which Authority of the Department passes the. Section 127 of the Income Tax Act. Cessation of exemption Section 128.

Interpretation of sections 24 to 28 24. Section 127 of the Income Tax Act A Directors Admission to Undisclosed Income cannot be a Ground for Transferring a Case. Act Nepal provides in depth comprehensive content with many tools summaries a forum for acts rules regulations in Nepal.

1271 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which this Chapter applies or tax for any previous year of assessment remaining unpaid and those regulations may in particular and without prejudice to the generality of the foregoing include. 1Power to transfer cases 2. Remission of tax 129 A.

Gross income of an employee does not include amounts paid or expenses incurred by the employer for educational assistance to the employee if the assistance is furnished pursuant to a program which is described in subsection b. INCOME TAX ACT 1967. 127 1 The Director General or Chief Commissioner or Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after recording.

This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3A of ITA 1976 which is claimable as per government gazette or with a ministers approval letter. 127AAuthentication of notices and other documents- 1 Every notice or other document communicated in electronic form by an income-tax authority under the Act shall be deemed to be authenticated- a in case of electronic mail or electronic mail message hereinafter referred to as the e-mail if the name and office of such income-tax authority-. Educational assistance programs a Exclusion from gross income 1 In general Gross income of an employee does not include amounts paid or expenses incurred by the employer for educational assistance to the employee if the assistance is furnished pursuant to a program which is described in subsection b.

INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002. Internal Revenue Code Section 127 was created by Congress in 1978 as a temporary expiring tax benefit intended to allow employers to provide tax-free assistance to their employees who were continuing to pursue their education while working. Approved ServicesProjectsASP-Section 127 The income of companies undertaking ASP is exempted at statutory levelThe quantum of tax exemption on statutory income varies between 70 and 100 for a period of 5 to 10 years from the date the first income is generatedThe quantum of exemption available are as follows.

Income Tax 5 Section 23. The said section reads as follows. It was finally made permanent in 2012.

127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount equal to the lesser of. 127 a Exclusion From Gross Income. Appeal to the Commissioner Appeals-.

Clubbing Of Income Under Income Tax Act 1961 With Faqs

Income Tax Case Laws Set Off Carry Forward Of Losses Section 70 To 80 Income Tax Act

Fear Of Taxes For Business Owners Income Tax Property Tax Tax Attorney

Flat Interest Rate Vs Diminishing Balance Interest Rate Excel Based Calculator To Convert Between Flat Diminish Interest Rates Finance Guide Personal Loans

25 Key Income Tax Case Laws Of The Year 2021 Taxmann Com

How To Track Gst Registration Application Status In Overview Status Application Pre And Post

What Are The Benefits Available For Start Ups Under The Income Tax Act Taxmann Blog

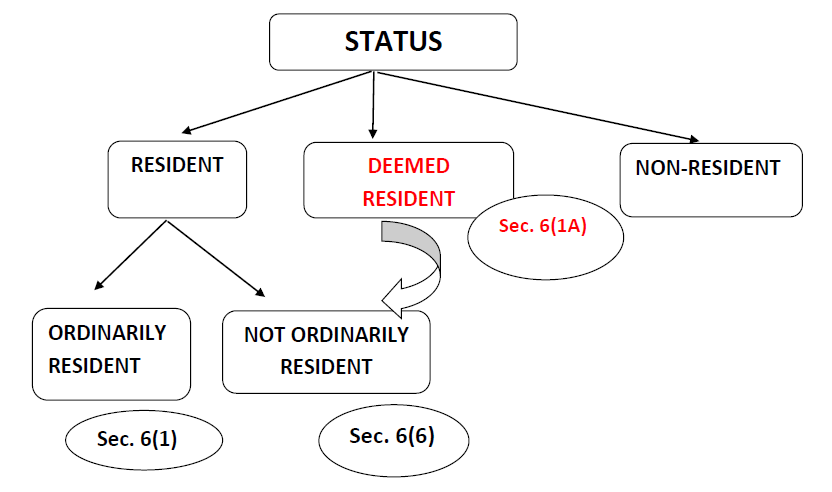

Nri Status For Financial Year 2020 21 New Circulars Sbnri

Change Of Assessing Officer And Jurisdiction For Income Tax Sid Associates

3 224 Likes 12 Comments Mochi Studies On Instagram Holidays Aren T Holidays With Hand Lettering Worksheet School Organization Notes Notes Inspiration

Penalties Under Income Tax Act 1961

No Dissolution Clause In The Trust Deed Whether Registration U S 12ab Can Be Denied The Proposition Taxact Clause

Solution For Dsc Trouble Shooting On Gst Website Https Taxguru In Goods And Service Tax Solution Dsc Trouble S Solutions Goods And Service Tax Indirect Tax

Private Company Employee Income Tax Calculation 2022 Reimbursement Pf Gratuity Hra Lta The Financial Express

Notary Logo Design Attorney Branding Kit Lawyer Logo Scales Etsy In 2022 Branding Kit Law Branding Notary

The Financial Planning Flowchart Financial Planning Financial Flow Chart